Reuters reports French jobless rate hits 10.3 pct, highest in 13 years

France's unemployment rate rose to 10.3 percent in the third quarter of 2012, its highest since the third quarter of 1999, from 10.2 percent in the previous quarter, data published by national statistics office INSEE showed on Thursday.How high will unemployment rise before it reverses as Hollande promises?

Youth unemployment rose more markedly, with the jobless rate edging up to 24.9 percent, from 23.6 percent, among people under 25 years old. That was higher than any quarter on records going back to the start of 1996.

On the non-ILO measure issued by the Labour Ministry, the picture is even bleaker, with October data showing mainland jobless totals at 3.1 million, the highest in 14 years.

Francois Hollande, who took over in May as France's first Socialist president in 17 years, has promised to reverse the upward trend by the end of 2013.

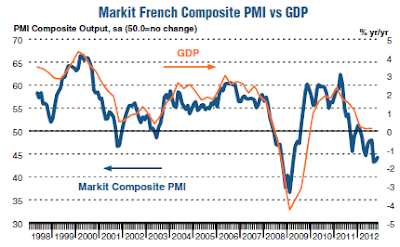

While pondering that question, please note the Markit France Services PMI® shows new business falls at sharpest rate since April 2009.

SummaryExpect a plunge in GDP and further plunge in employment to catch up to the PMI plunge in the above chart.

French service providers reported another decrease in business activity during November. Although the slowest in three months, the rate of contraction was solid. Underlying the drop in activity was a marked and accelerated contraction of new business. Backlogs of work and employment both decreased, albeit at weaker rates.

Composite data showed that business activity across the French private sector fell for the ninth month running in November. The rate of contraction remained considerable, despite easing to the slowest in three months.

The level of new business placed with service providers in France decreased for the eighth month running in November. The rate of contraction was substantial, having accelerated to the sharpest since April 2009. Panel members commented that general market conditions remained tough, with clients cancelling projects and making fewer invitations to tender.

With manufacturers also registering a steep (albeit slower) decline in new orders, overall new business across the French private sector continued to contract at a marked pace in November.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com